Some Of Summitpath Llp

Table of ContentsOur Summitpath Llp IdeasWhat Does Summitpath Llp Mean?Summitpath Llp Things To Know Before You Get ThisThe Buzz on Summitpath Llp

Most just recently, released the CAS 2.0 Technique Development Mentoring Program. https://summitpath-llp.webflow.io/. The multi-step mentoring program consists of: Pre-coaching positioning Interactive group sessions Roundtable discussions Embellished coaching Action-oriented mini plans Firms seeking to broaden right into consultatory services can additionally turn to Thomson Reuters Technique Ahead. This market-proven methodology supplies content, devices, and support for firms interested in advising servicesWhile the modifications have opened a number of growth chances, they have actually additionally resulted in challenges and problems that today's companies require to have on their radars., firms need to have the capability to promptly and effectively perform tax research and enhance tax obligation coverage performances.

Furthermore, the brand-new disclosures might lead to a rise in non-GAAP measures, traditionally an issue that is extremely inspected by the SEC." Accountants have a great deal on their plate from regulatory modifications, to reimagined company models, to an increase in client assumptions. Keeping rate with everything can be tough, but it does not have to be.

The Basic Principles Of Summitpath Llp

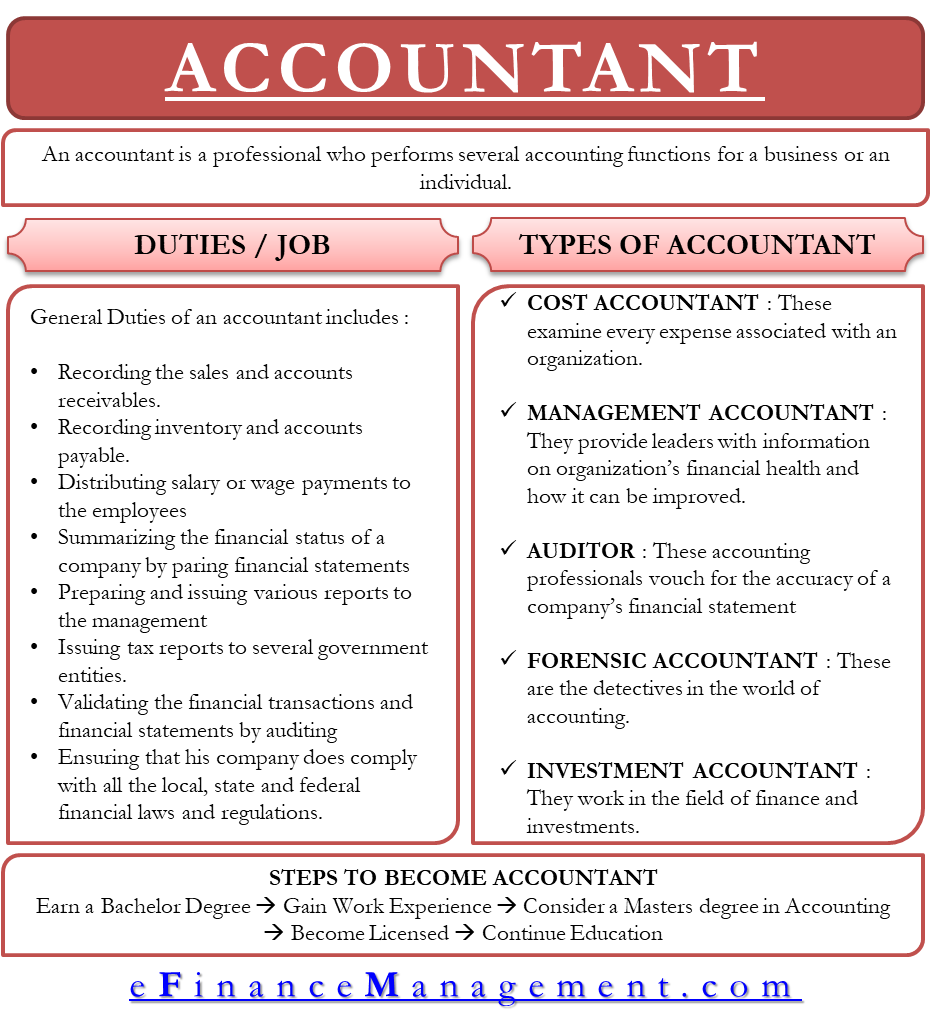

Below, we describe 4 certified public accountant specializeds: taxes, administration accountancy, financial coverage, and forensic accountancy. Certified public accountants concentrating on tax aid their customers prepare and submit income tax return, decrease their tax concern, and prevent making mistakes that can bring about costly penalties. All CPAs need some understanding of tax obligation legislation, yet concentrating on tax indicates this will certainly be the focus of your work.

Forensic accountants normally begin as basic accountants and move right into forensic audit roles over time. They require strong analytical, investigatory, service, and technological accountancy abilities. Certified public accountants that concentrate on forensic accounting can in some cases go up right into monitoring bookkeeping. CPAs need at the very least a bachelor's level in accountancy or a comparable area, and they must complete 150 debt hours, consisting of bookkeeping and business courses.

No states need a graduate degree in accounting., auditing, and tax.

Accountancy also makes practical feeling to me; it's not just academic. The Certified public accountant is an essential credential to me, and I still get proceeding education and learning credits every year to keep up with our state needs.

Rumored Buzz on Summitpath Llp

As a freelance consultant, I still utilize all the standard building blocks of accountancy that I learned in university, pursuing my CPA, and functioning in public accounting. Among the important things I really like concerning audit is that there are many various jobs available. I determined that I intended to start my career in public audit in order to find out a lot in a short amount of time and be exposed to different kinds of clients and various locations of audit.

"There are some work environments that do not wish to take into consideration somebody for a bookkeeping duty who is not a CERTIFIED PUBLIC ACCOUNTANT." Jeanie Gorlovsky-Schepp, CPA A CPA is a very important credential, and I wanted to place myself well in the like it market for different jobs - CPA for small business. I chose in college as a bookkeeping major that I desired to try to get my certified public accountant as quickly as I could

I've fulfilled a lot of great accounting professionals who don't have a CERTIFIED PUBLIC ACCOUNTANT, however in my experience, having the credential truly assists to promote your know-how and makes a difference in your settlement and occupation options. There are some offices that don't intend to take into consideration somebody for a bookkeeping duty that is not a CERTIFIED PUBLIC ACCOUNTANT.

Our Summitpath Llp Diaries

I really delighted in working with numerous kinds of jobs with various customers. I discovered a lot from each of my colleagues and customers. I collaborated with various not-for-profit companies and discovered that I want mission-driven companies. In 2021, I made a decision to take the following action in my audit occupation journey, and I am currently an independent bookkeeping specialist and organization expert.

It remains to be a development location for me. One crucial quality in being an effective CPA is really appreciating your clients and their companies. I enjoy working with not-for-profit clients for that really reason I seem like I'm actually adding to their objective by aiding them have good economic information on which to make clever business decisions.